ManpowerGroup Labor Market Forecast Q2 2025

With the gradual restart of economic growth, Hungarian companies are also planning a slight overall increase in headcount for the second quarter of 2025: over the next three months, 33 percent of domestic employers plan to expand their current workforce, while 25 percent anticipate reductions — according to the newly released Labor Market Forecast by Manpower Hungary.

ManpowerGroup conducted its quarterly survey in 41 countries worldwide, involving more than 40,000 employers, including a representative sample of 547 employers in Hungary, who were asked about their hiring intentions for the second quarter of 2025.

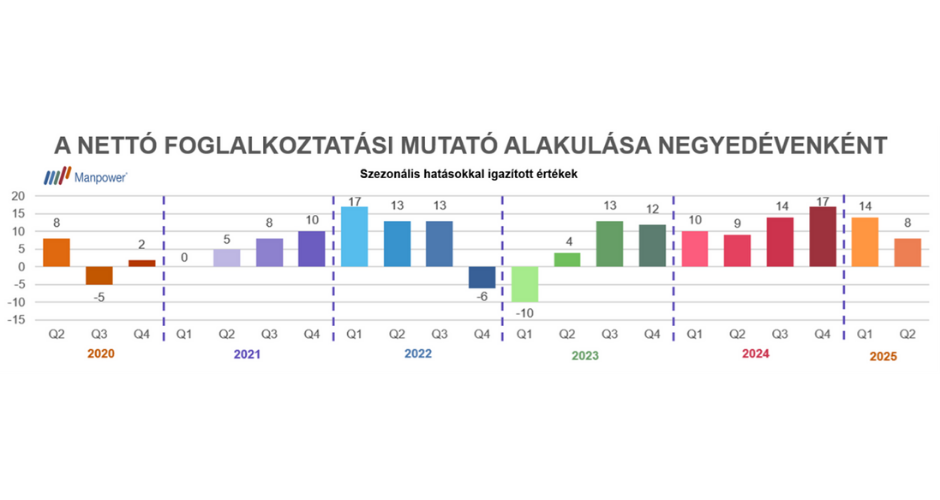

The seasonally adjusted Net Employment Outlook (NEO), derived from employers' responses, reached an average value of +8 percent. While this represents a decrease of 6 percentage points compared to the previous quarter and a 1 percentage point drop year-on-year, it still reflects a net positive outlook for workforce growth.

„While the latest GDP figures already indicate the slow return of economic growth, one-third of employers are planning to expand their workforce,” said Péter Varga, Managing Director of Manpower Hungary. “This suggests that a significant portion of companies are already factoring in a renewed uptick in their markets — though to varying degrees across different sectors. A positive development compared to the previous quarter is that companies in the automotive industry now collectively plan to hire more workers than they intend to lay off, and employers in the raw materials and manufacturing sectors also continue to have a positive outlook.”

A closer look at individual sectors reveals significant differences across industries. Headcount growth is expected to be well above average in healthcare and life sciences (NEO: +27%), finance and real estate (+23%), consumer goods and services (+20%), raw materials and manufacturing (+17%), and information technology (+16%). Near-average growth is projected in the logistics and automotive sectors (+6%). However, substantial workforce reductions are anticipated in energy and utilities (-37%) and communications services (-34%).

Significant regional disparities are also expected across the country. Employers' expectations are above the national average in Northern Great Plain (NEO: +22%), Central Transdanubia (+19%), and Northern Hungary (+13%). In other regions, workforce growth is expected to be around or below the national average. Southern Transdanubia (-4%), however, remains a negative outlier for nearly a year now, with more employers consistently anticipating layoffs than hiring.

Based on company size, micro-enterprises are the most pessimistic (NEO: -9%). In contrast, medium-sized companies (50–250 employees) and larger firms with under 1,000 employees are planning significantly above-average hiring (around +20%).

Compared to the previous quarter, global labor market expectations remain stable. The Net Employment Outlook currently stands at a high 25 percent. None of the 41 surveyed countries anticipate a decline, and only one country — Argentina — may experience stagnation. In Europe, expectations are slightly below average overall, but standout hiring plans are reported in the United Kingdom (NEO: +31%), the Netherlands and Norway (+27% each), Switzerland (+26%), and Ireland (+25%). Outside Europe, the strongest anticipated workforce expansion in the coming months is in India (+43%), the United States (+34%), Mexico (+33%), and Canada and Costa Rica (both +32%).

In the variable section of this quarter's survey, respondents were asked about their use of new technologies (e.g., artificial intelligence) in recruitment, onboarding, and talent development. Among Hungarian companies, 14 percent consider themselves early adopters who are already fully leveraging the advantages of these technologies. 24 percent use certain elements of such applications, and another 23 percent plan to adopt them within the next year.

However, the introduction of AI still presents serious challenges for most. The most commonly cited obstacles include: lack of employee digital skills (34%), high investment costs (28%), lack of appropriate tools (27%), and compliance with data protection and regulatory requirements (24%).